child tax portal not working

Parents who have low incomes may get help paying for it through various programs. In addition to religiously exempt child day programs 221-289031 and certified preschool or nursery school programs 221-289032 certain child day programs are also not required to be licensed and are considered exempt from licensure per 221-289030 of the Code of Virginia.

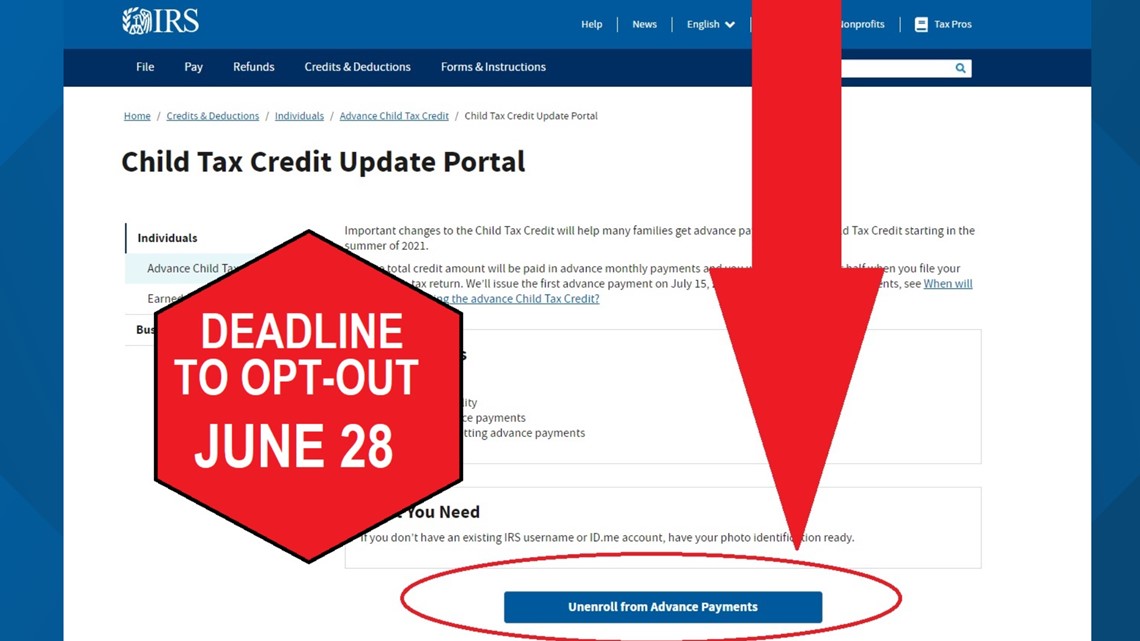

How To Opt Out Or Unenroll From The Child Tax Credit Payments Wfmynews2 Com

It aids childrens healthy development and gives parents peace of mind.

. Help with the cost of paying for approved childcare - Tax-Free Childcare 15 and 30 hours childcare childcare vouchers tax credits Learner Support. Visa Liberalisation Action Plan. All working families will get the full credit if they make up to 150000 for a couple or 112500 for a family with a single.

EUBAM is working with Moldova and Ukraine especially the customs services t Read more. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. And this platform is our path ahead for generations to come.

Not everyone is required to file taxes. 3600 per child under 6 years old. We collect the money that pays for the UKs public services and help families and individuals with targeted.

We dont use your email calendar or other personal content to. Entered your information in 2020 to get stimulus Economic Impact payments with the Non-Filers. Following investigation if you decide to let the person return to a position working in regulated activity with children or vulnerable adults then there may not be a legal duty to make a referral.

Paid regardless of your income source. We help you take charge with easy-to-use tools and clear choices. This is our time to choose.

Viasats internet service allows you to stay seamlessly connected to family friends work and the world. The Child Tax Credit Update Portal is no longer available. Search vaccinesgov text your ZIP code to 438829 or call 1-800-232-0233.

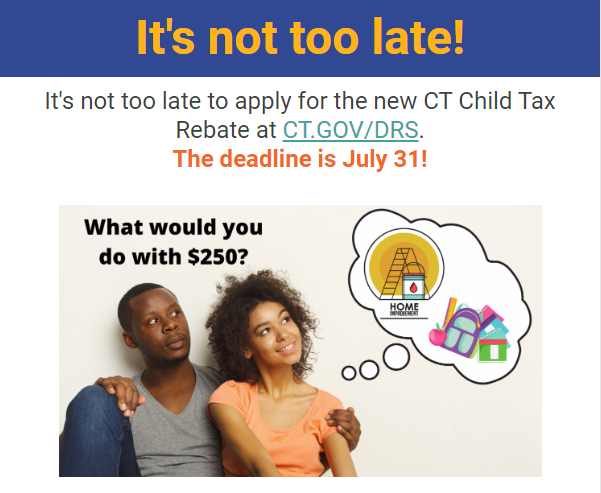

Child support is paid by parents who do not live with their children or who share care with someone else. You may be eligible for a child tax rebate of up to a maximum of 750 250 per child up to. The DOI system provides a.

Affordable child care is important to Minnesota families. B Numbering 1 FAR provisions and clauses. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the return or.

HM Treasury is the governments economic and finance ministry maintaining control over public spending setting the direction of the UKs economic policy and working to achieve strong and. Subpart 522 sets forth the text of all FAR provisions and clauses each in its own separate subsection. Not for seniors workers or families.

File Pay Apply for a Business Tax Account Upload W2s Get more information on the notice I received Get more information on the appeals process Check my Business Income Tax refund status View South Carolinas Top Delinquent Taxpayers. Modification as used in this subpart means a minor change in the details of a provision or clause that is specifically authorized by the FAR and does not alter the substance of the provision or clause see 52104. The child tax rebate which was recently authorized by the Connecticut General Assembly and signed into law by Governor Ned Lamont is intended to help Connecticut families with children.

Begging and child labour was considered as a service in exchange for quranic education and in some cases continues to this day. On October 19 2021 the Texas Workforce Commission TWC approved distribution of 245 billion in American Rescue Plan Act funds for direct relief to child care programsOn February 1 2022 the Commission received an additional 1 billion of COVID-19 stimulus funding to the 2022 CCRF bringing the total available funds to 345 billion. You can be on salary and wages or receiving an income-tested benefit.

Not on health care or child care. In northern parts of sub-Saharan Africa Islam is a major influence. This effect is not driven by the underlying economic conditions the underlying local fraud environment or.

Enter Payment Info Here tool or. Who is Eligible. This year Americans were only required to file taxes if they.

A child can be immunocompromised and still healthy will be affected by COVID-19 its important to get them vaccinated as soon as possible to protect them against severe illness. 2021 Tax Filing Information Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you. To find your child a COVID-19 vaccine or booster near you.

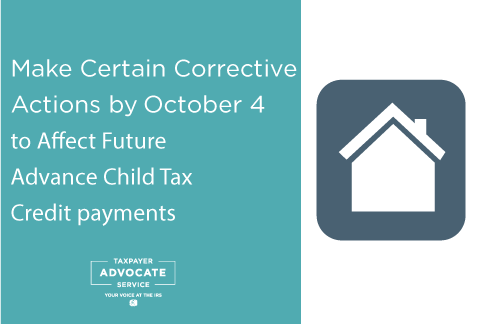

This is our moment to decide where our country goes from here. Working for Families payments. If you received advance child tax credit payments during 2021 and the credits you figure using Schedule 8812 Form 1040 are less than what you received you may owe an additional tax.

After a local newspaper closure local facilities increase violations by 11 and penalties by 152 indicating that the closures reduce firm monitoring by the press. EUBAM works with Moldova and Ukraine to help them meet the necessary standards of control for visa-free access to the EU. Free press release distribution service from Pressbox as well as providing professional copywriting services to targeted audiences globally.

Not in the fight against COVID-19 or the climate crisis. To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have. We canât afford to move backward.

Additional tax on excess advance child tax credit payments. Were transparent about data collection and use so you can make informed decisions. You may be eligible for Child Tax Credit payments even if you have not filed taxes recently.

These children aged 713 for example were called almudos in Gambia or talibés in SenegalThe parents placed their children with marabout or serin a cleric or quranic teacher. Moldova achieved this in 2014 under the Visa Liberalisation Action Plan VLAP. We are the UKs tax payments and customs authority and we have a vital purpose.

With a variety of plans to meet every need and every budget Viasat keeps you in the loop for news work weather politics sports and more. Outlook puts you in control of your privacy. 3000 per child 6-17 years old.

This is the web site of the International DOI Foundation IDF a not-for-profit membership organization that is the governance and management body for the federation of Registration Agencies providing Digital Object Identifier DOI services and registration and is the registration authority for the ISO standard ISO 26324 for the DOI system. There are 4 types of Working for Families tax credit payments.

It S Not Too Late To Apply For 250 Child Tax Credit East Haddam Youth Family Services Inc

White House Unveils Updated Child Tax Credit Portal For Eligible Families

Why Did The Irs Close The Child Tax Credit Online Portal Nbc 5 Dallas Fort Worth

Child Tax Credit Portal Issue R Irs

The Irs Is Shutting Down Its Child Tax Credit Portal For Now Best Life

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

New Features In The Child Tax Credit Update Portal Youtube

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Tax Tip Use The Child Tax Credit Update Portal To Make Changes For Future Payments

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Payments Irs Online Portal Now Available In Spanish Nov 29 Is Last Day For Families To Opt Out Or Make Other Changes Larson Accouting

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

Change Address On Child Tax Credit Update Portal Taxing Subjects

Spanish Version Of Irs Child Tax Portal Now Available King5 Com

Child Tax Credit 2021 Update Parents Can Use Irs Portal To See Where Their 300 Is And Opt Out Of Payments The Us Sun

Irs Child Tax Credit Open To Unenroll And Check Eligibility

Child Tax Credit Portal How To Use The Irs Tool To Enroll For 2021 Nj Com

Online Portal Ensures All Who Qualify Can Get Child Tax Credit 12newsnow Com